If you're new, here's the catch-up:

- Ethereum began staking Dec. 2020

- Lock your ETH to help secure network

- 2 years later, the ability to withdraw this ETH is on the horizon

- Shanghai Upgrade March 2023 = ETH staking withdrawals

Perfect, we are now on the same page!

If you are confused on what will happen post-staking withdrawals, we don't blame you, most people are, and have been for years:

THE FUD:

Lots of people share the opinion that when stakers are able to withdraw their ETH (+ rewards), there will be huge exodus of ppl insta-dumping their precious ETH which has been locked up,

especially those that have been waiting for 1-2 years!

THE FACTS:

- Withdrawals have a queue, meaning not many ETH can unstake at once.

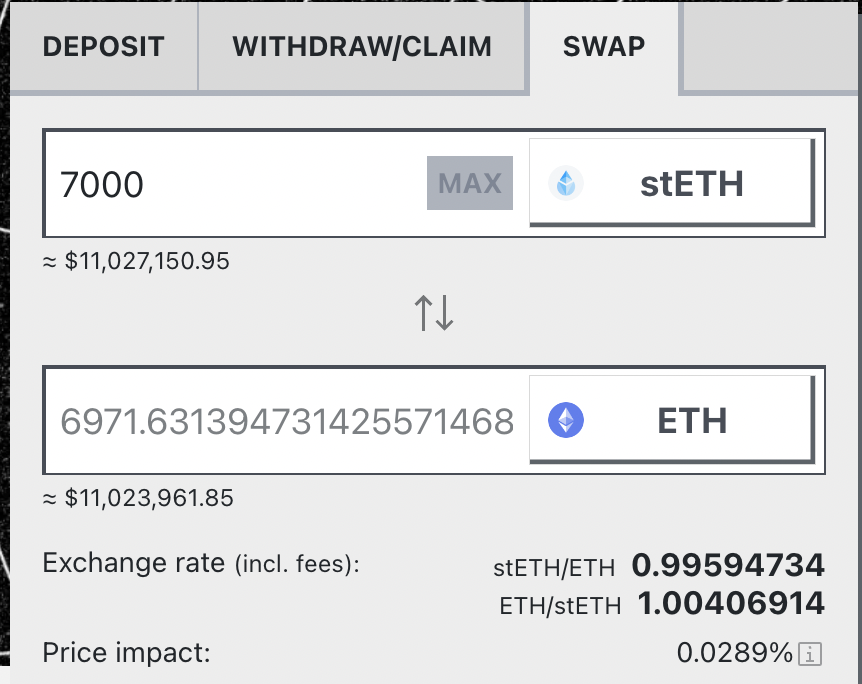

- A LOT of staked ETH is already liquid via liquid staking tokens (i.e Lido stETH)

(~$1 billion of staked ETH (stETH) liquidity available on Curve)

(you could sell $11,000,000 stETH right now with zero price impact)

3. The more stakers that leave --> higher APY for those that remain (incentive)

WHY NO ONE IS SELLING THE WITHDRAWALS:

Exhibit #1: NO ONE IS SELLING AT A LOSS

Yes, people have been actively locking up their ETH over the last 2 years since for all of 2021 and 2022.

But that was a raging bull market, meaning most of these people staked their ETH when it was high in USD price.

Today, the ETH price is sitting at $1590, making 83% of all ETH stakers 'underwater' in USD terms. So unless ETH doesn't sky-rocket to $4,000 in the next 2-3 months in-time for the Shanghai upgrade, we really don't think anyone would logically opt-out of receiving yield and sell their ETH at a loss.

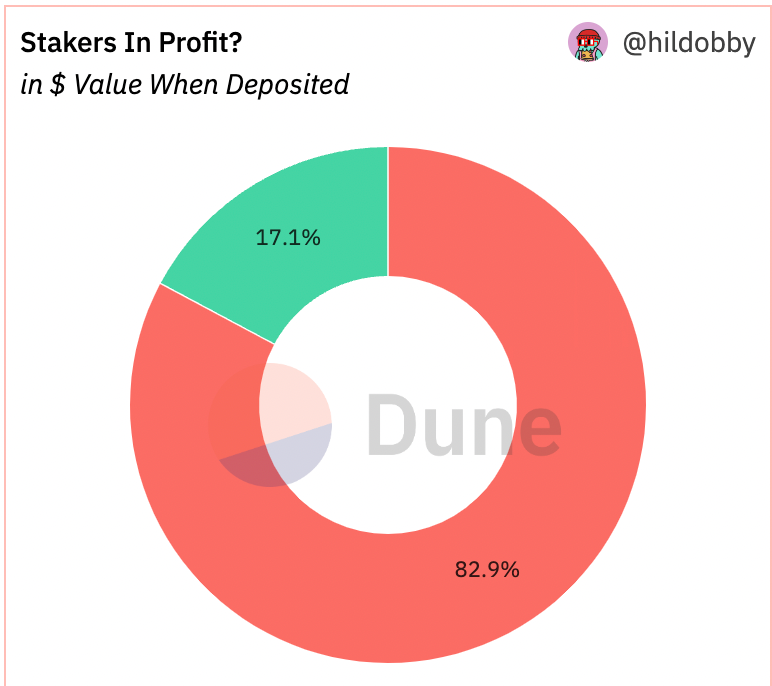

EXHIBIT #2: 90% are not in profit

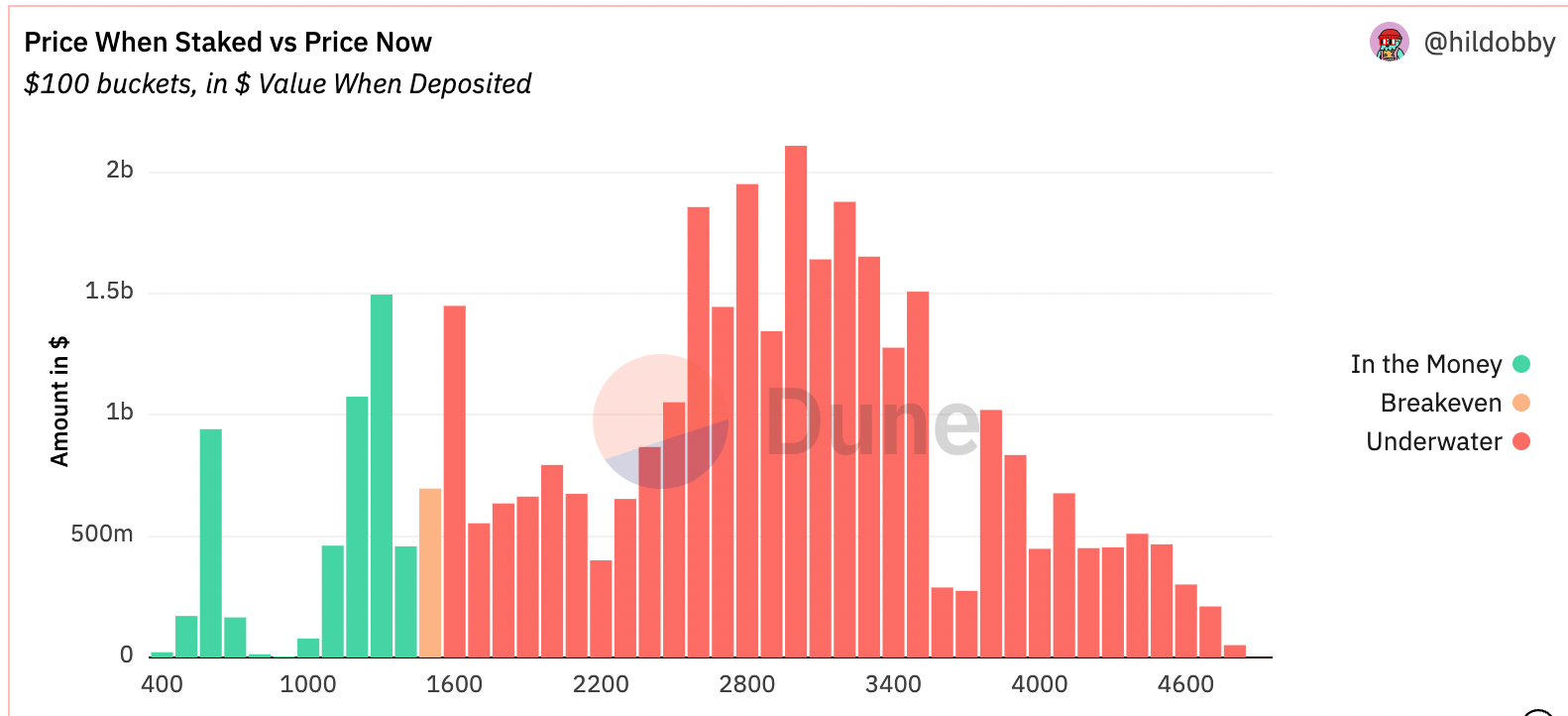

This is a great piece of data (via Dune) - it shows us how much ETH (in USD) was staked, and at what ETH price it was staked.

The green bars = people that staked when ETH was BELOW today's price ($1590 as of Jan 31, 2023)

The red bars = people that staked when ETH was ABOVE today's price.

So as you see, the majority of ETH was staked at levels high above what ETH is currently trading at, hence stakers are not in the money, and selling would not make sense, no matter how long you've been waiting.

SUMMARY

Will some people sell when withdrawals are unlocked? - sure.

Will most people sell when withdrawas are unlocked? - no.

CAN most people sell when withdrawals are unlocked? - no! (queue + underwater)

In fact, some argue that the opposite will happen:

- The fear or not knowing when you can redeem staked ETH is gone

- More people willing to stake ETH since no lock-up period

- More ETH purchased off market to stake.

- Price go up.

At BankRunners, we are in the camp of 'no-FUD' for Shanghai withdrawals.

We shall see, see you in March!

Happy HODL'ing!

Disclaimer: Author holds ETH, stETH and other crypto...