Glossary:

- Perpetual Swaps

- The $35 Trillion Dollar Opportunity

- DeFi - 0 to 100, Real Quick

- The Hidden Lagging Indicator

- Growth Potential of PERP DEXs

- Invalidation (bear case)

- Summary

Perpetual Swaps (PERPs)

Before PERPs: you buy $1,000 of ETH, and if it goes up 5%, you're up 5%.

After PERPs, you can buy $1,000 of ETH,

have ETH go up 5%,

and you are now up 250%! 😲

How? Through leverage. (50x leverage in this case)

On the flip-side, if ETH goes down, you have the same multiplied exposure, and can lose money just as quick.

leverage is a hell of a rug.

— Kris Kay | 🦇🔊🍩 DeFi Donut (@thekriskay) November 8, 2022

But if you think this enhanced risk of losing money scares away degen traders, boy are you wrong..

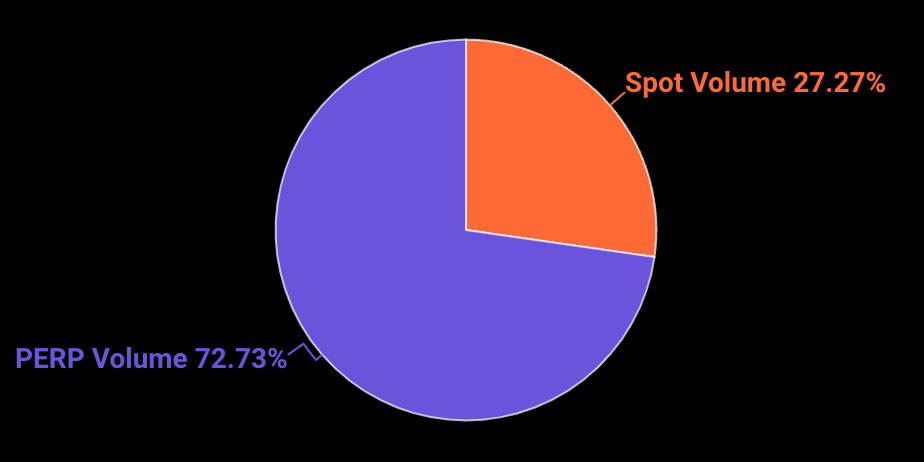

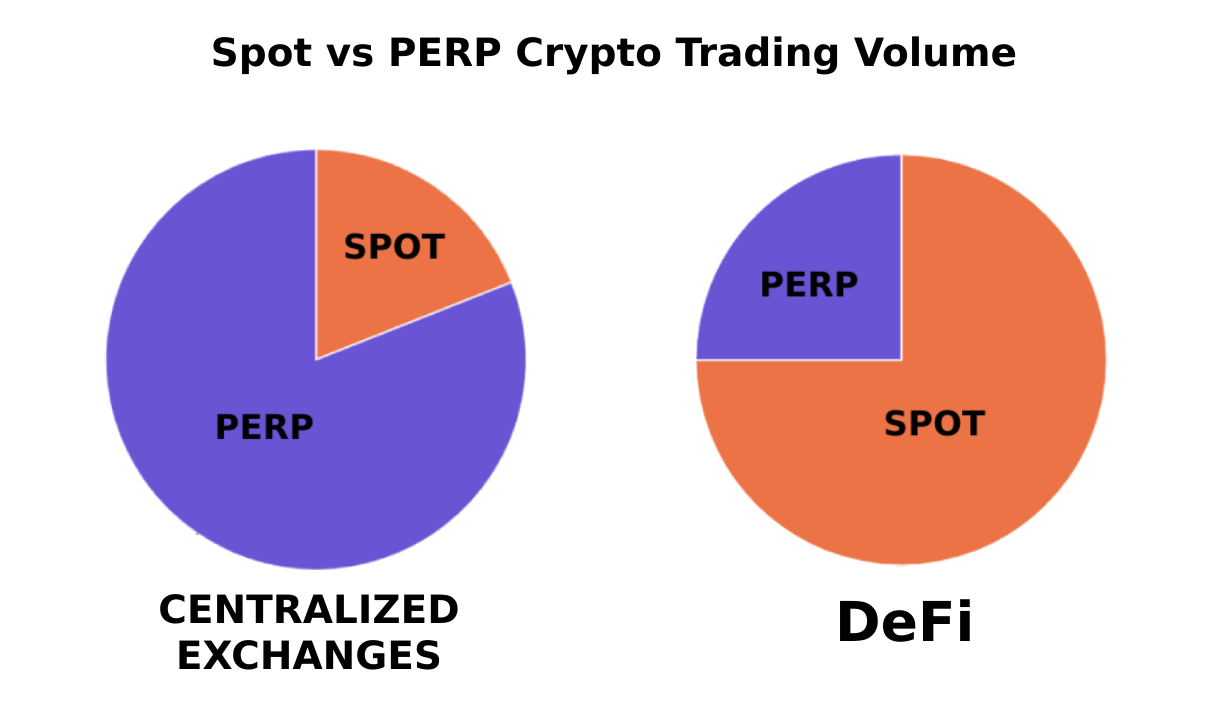

March 2023 - Spot vs PERP Crypto Trading Volume:

- Total Crypto Spot Volume: $1.07 trillion.

- Total Crypto PERP Volume: $2.77 trillion. 😲

That's right, 72% of all crypto trading volume in March was via leverage (margin)!

Wait a minute...these leveraged PERP trades generate 3x more volume than the normal buy/sell activity in all of crypto?

...why is no one talking about this?

Probably because the PERP-friendly, centralized exchanges like Binance, are quietly raking in millions of dollars per day through the fees they charge PERP traders.

..why bring attention to an unregulated cash cow?

"in a gold rush, it's good to be in the shovels & picks business"

To clarify:

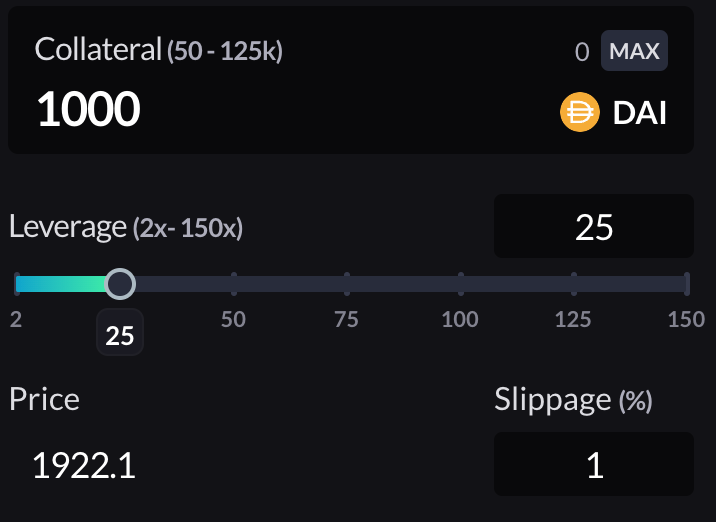

Perpetuals 101:

- You have 2 options: Long or Short an asset

- Long = betting on price going up

- Short = betting on price going down

- Collateral = how much are you putting up for your bet

- Next choose your leverage (1x - 100x+) multiplies your collateral.

Basically, traders have the temptation of multiplying their wins by a crazy amount, similar to trading on margin.

So a $1,000 bet, on 10x leverage = $10,000 position!

This means, if the asset you made a $1,000 bet on, goes up 10%, you're up 100% and just made a $1,000 profit, doubling your money.

The Risks of PERP Trading:

- The higher the leverage, the higher the risk (liquidation)

- Each PERP trade has a liquidation price.

- Liquidation = lose your entire collateral.

- You can get 'liquidated' if the price moves in the opposite direction far enough to where it breaks through your leverage limit.

The Cost of PERP Trading:

- Funding Fee = ongoing fee exchanged by shorts and longs, making it possible for a never-expiring contract to exist.

- Rollover Fee = ongoing fee paid to the 'house' while position is open, again making a never-expiring contract possible.

- Open Interest = the current outstanding, open leveraged trades value (in USD), which is being taxed the funding and rollover fees. (i.e how many open bets are there currently)

$35 Trillion Opportunity

Did you know?

- Around 72% of (RIP) FTX's revenue during peak bull market (2021) came from derivatives trading fees, while ~16% of its revenue came from spot trading fees.

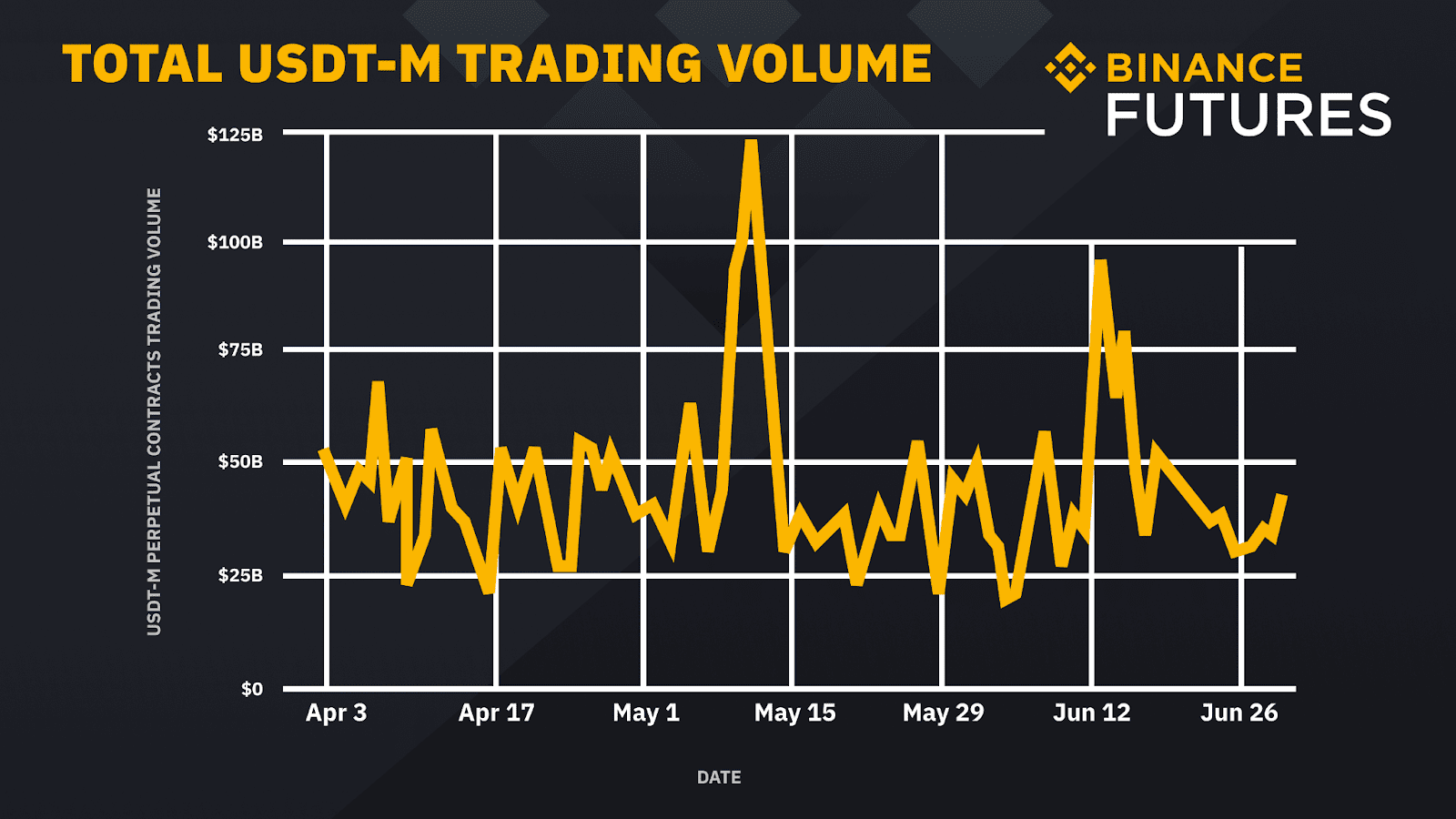

- Binance has earned an estimated $17 billion in revenue from its derivatives business, in a span of just 2-3 years. [source]

- In the peak month of the 2021 bull market (May '21), Binance earned $1.14 billion in revenue from its derivatives trading business. [source]

- Total PERP volume (all coins) in 2022 = ~$35 trillion

- Total Spot volume (all coins) in 2022 = ~$13 trillion

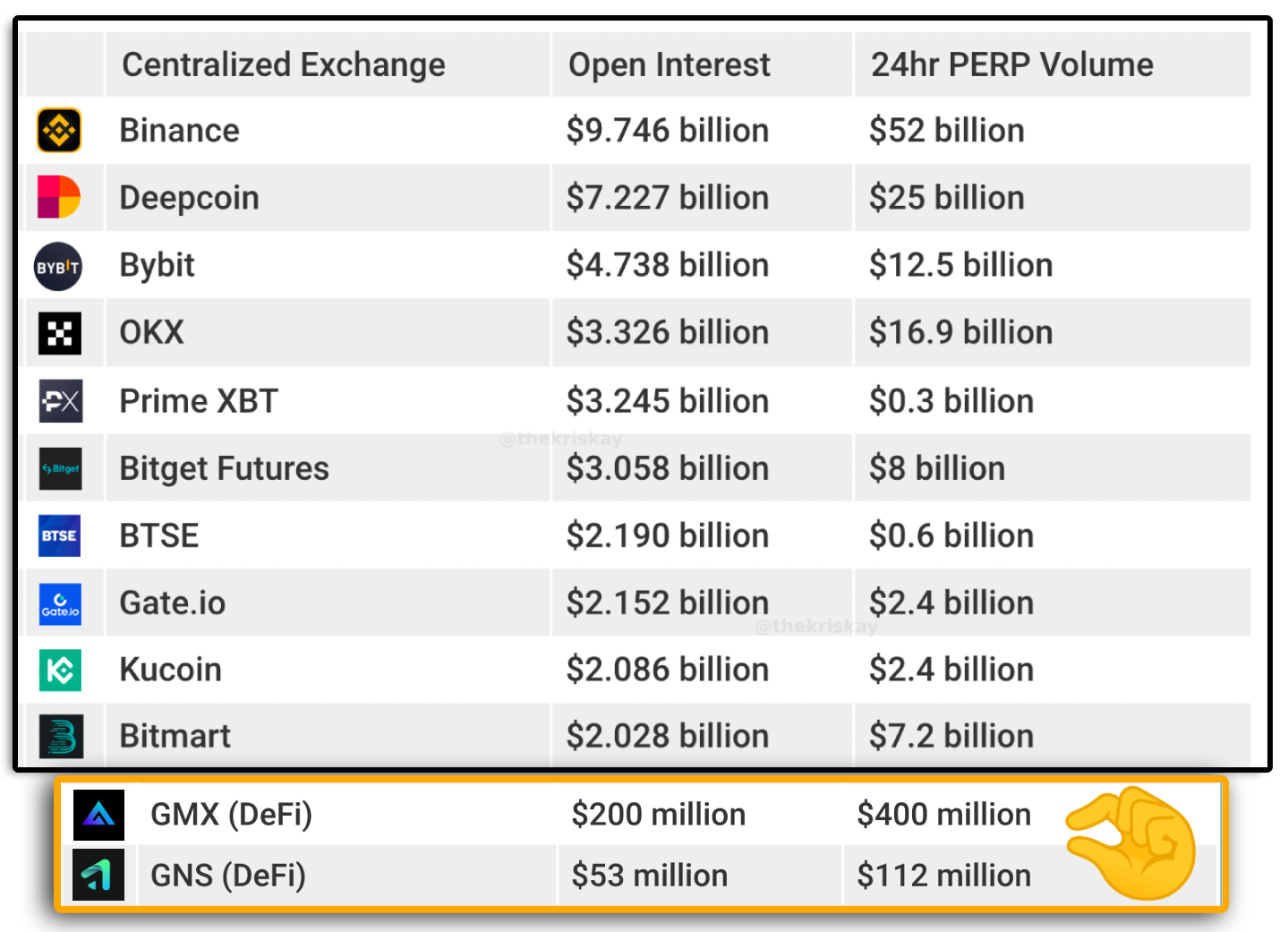

Battle of The CEX's

Centralized exchanges know one thing for certain, the biggest cash cow right now is: offering Perpetual futures trading to their customers, and raking in the fees:

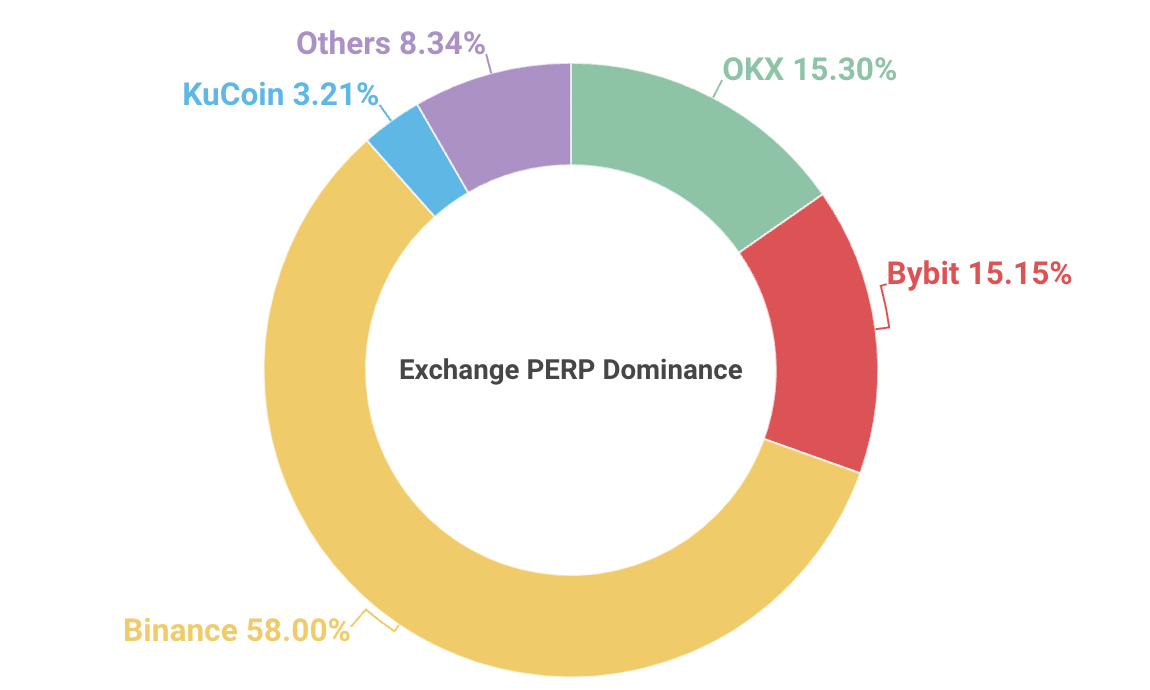

As seen below, Binance holds a clear lead in the dominance of perpetual futures trading volume.

But with such a lucrative industry such as PERP trading, even a 1% slice, of a $30 billion / year, fee-revenue pie, is worth competing over.

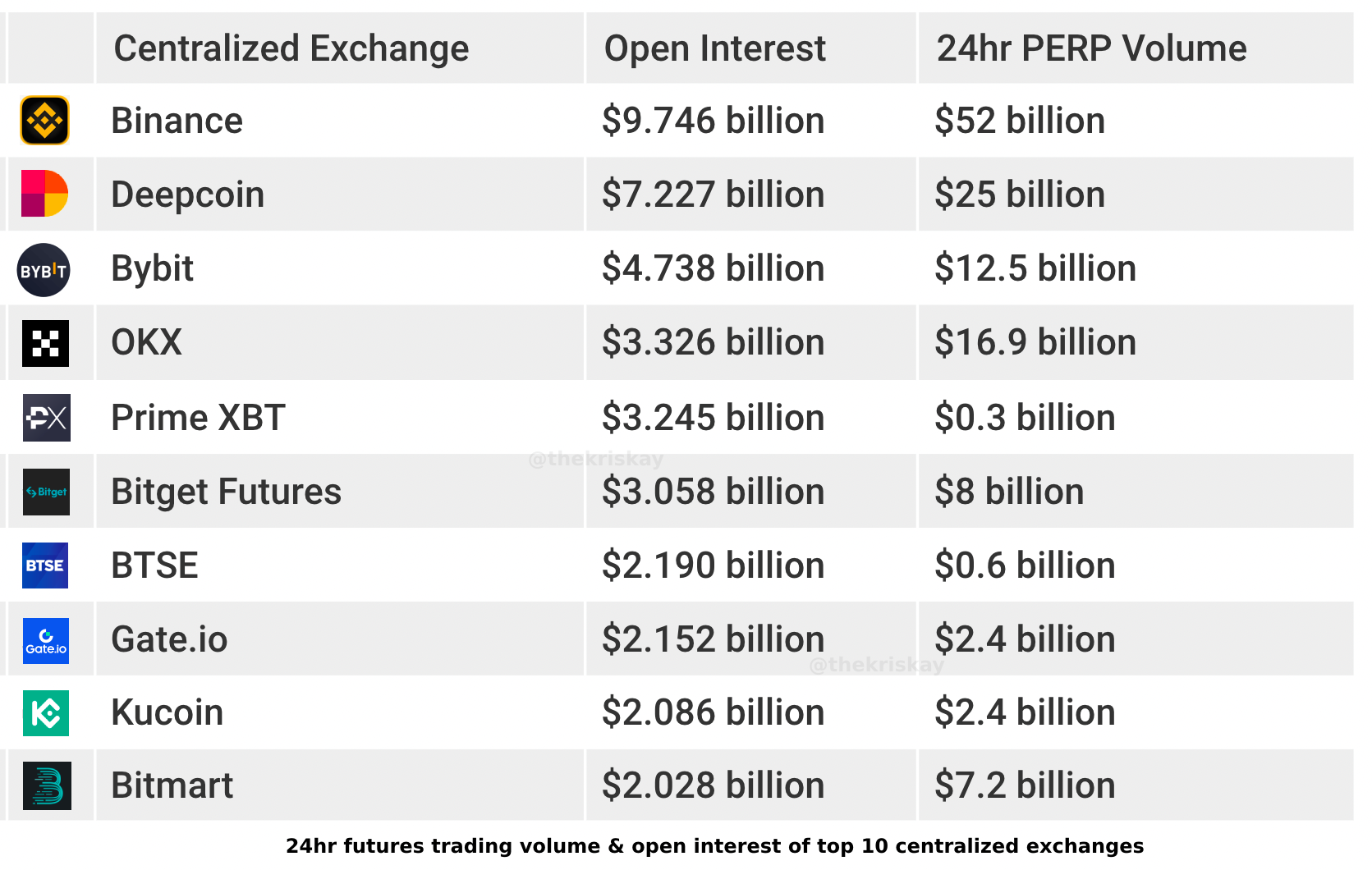

Top 10 centralized exchanges, sorted by PERP Open Interest:

DeFi - 0 to 100, Real Quick

A few years ago, DeFi apps overtaking centralized exchanges in ANY metric, was a pipe dream.

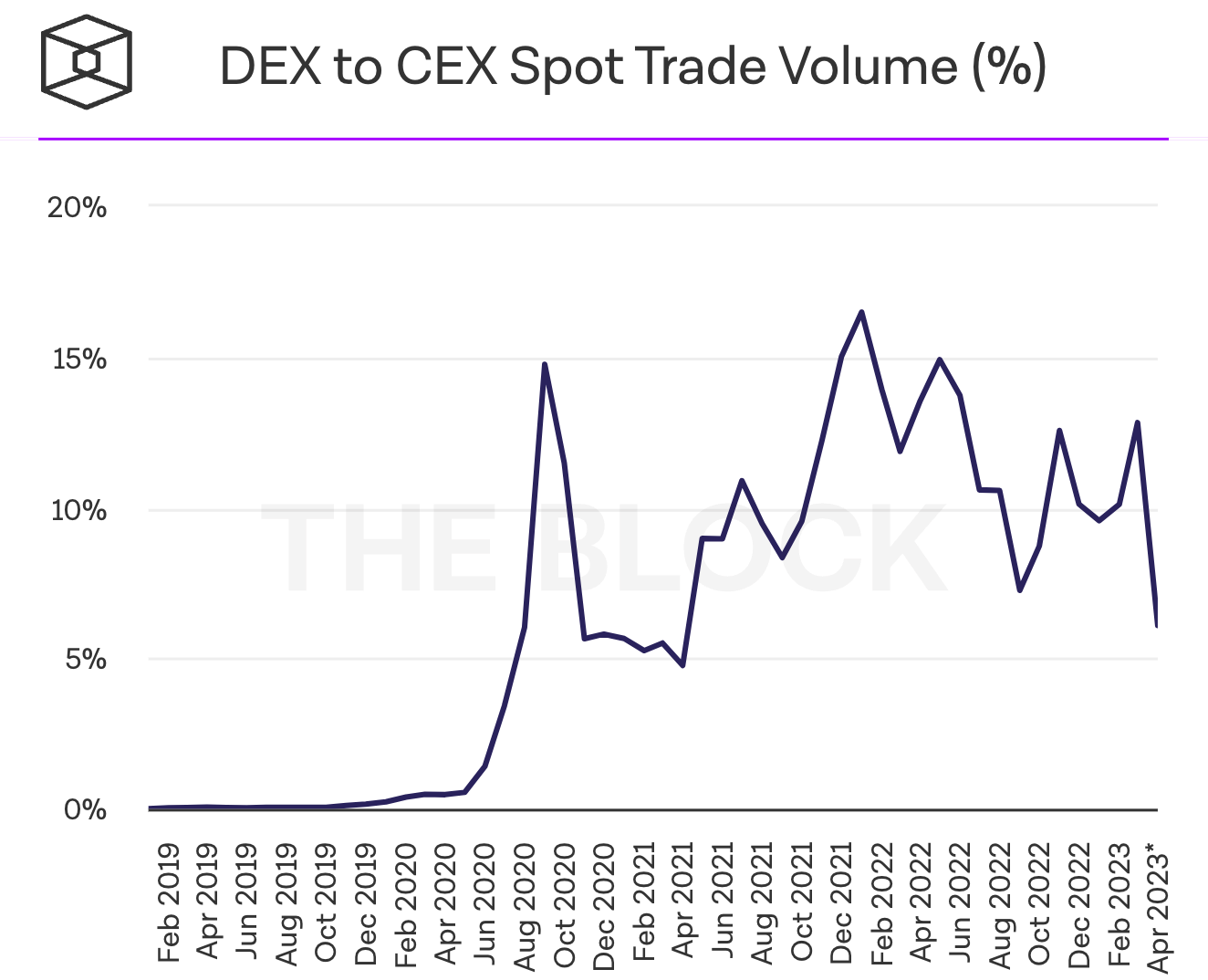

In March 2020, only about 0.48% of all crypto spot trade volume happened on decentralized exchanges.

Fast forward 3 years, and in March 2023, 12.8% of all crypto (spot) trade volume happened on decentralized exchanges!

That's a 30x increase in DEX dominance, in 36 months:

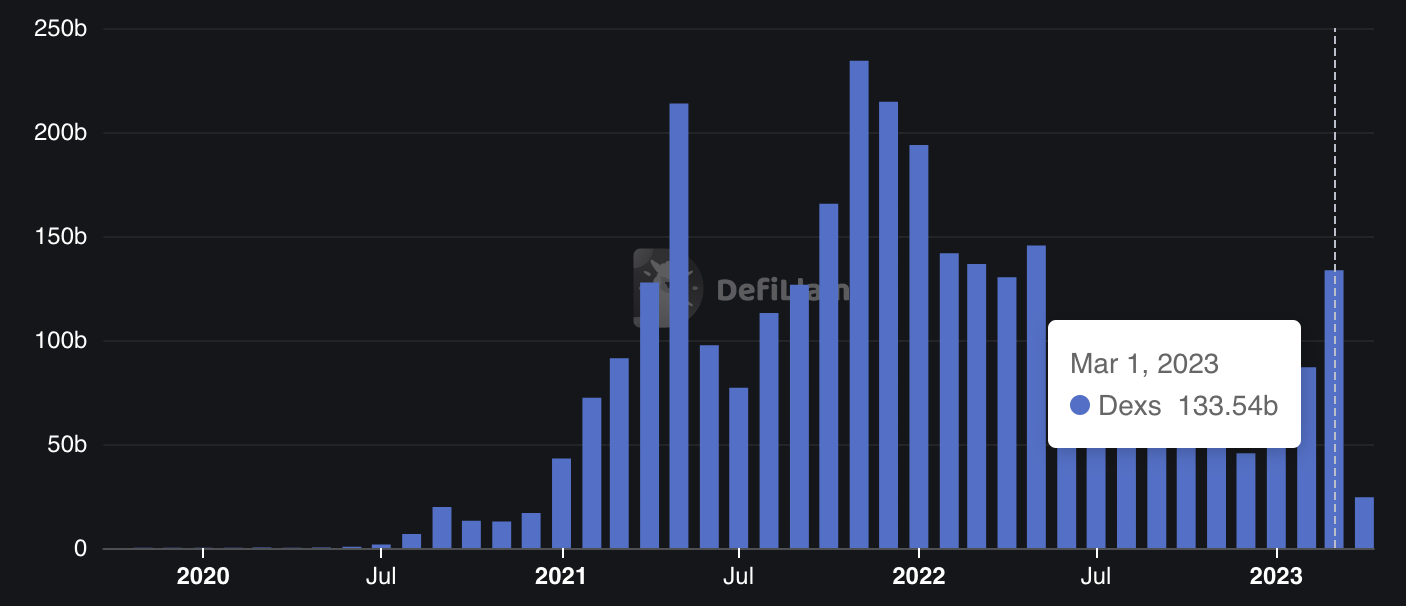

In 3 short years, DEX volume went from $230 million per month, to $100 billion per month:

If that data didn't convince you that DeFi moves quick, how about this:

In March, Coinbase saw $49 billion of trade volume, while Uniswap saw $71 billion.

Meaning Uniswap (decentralized exchange) saw 45% higher crypto trading volume than Coinbase!

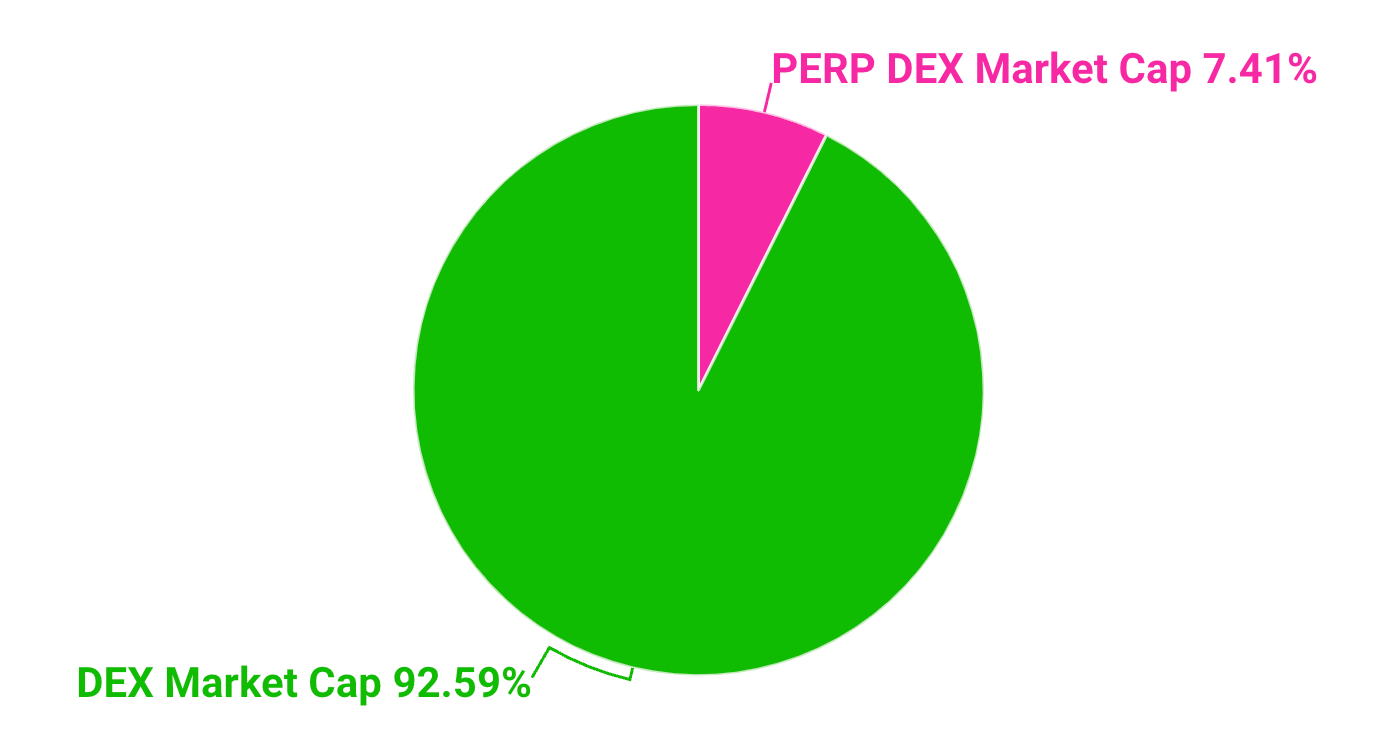

The Hidden Lagging Indicator

- Crypto spot trading volume on centralized exchanges grew exponentially.

- Crypto spot trading volume in DeFi quickly gained market share.

- Crypto PERP trading volume on centralized exchanges outgrows spot volume.

- ??????

For those that cannot read between the lines: if PERP volume is 2x-3x above spot volume in the centralized world, it only makes sense the the same happens in the DeFi world. (hence lagging indicator)

The question now is, what will be the next 'Uniswap' of the decentralized perp world, and how do we ride the wave?

- The top 2 decentralized exchange tokens have a combined, FULLY DILUTED market cap of ~$9 billion. (UNI, CRV) (IN A BEAR MARKET!)

- The top 2 DeFi Perp tokens have a combined market cap of ~$800 million. (GMX, GNS) - (IN A BEAR MARKET!)

Not only are the PERP tokens 700% behind in market cap,

..but the PERP tokens in question both have a generous revenue share, direct to stakers, whereas UNI and CRV, do not.

If PERP-to-SPOT volume ratio should follow the centralized exchange one, then we can expect that GMX & GNS will eventually see 2x-3x the volume of the current DEX leaders.

If valuations follow the fundamentals, this means PERP tokens just catching up (+700% growth in market cap), is not enough, their fundamental value should surpass the spot DEX market caps by quite the difference.

Long Story Short: PERP tokens should be more valuable than DEX tokens.

But what is that number? How much can they grow? Wen Moon?

The Bull Case For DeFi PERPs

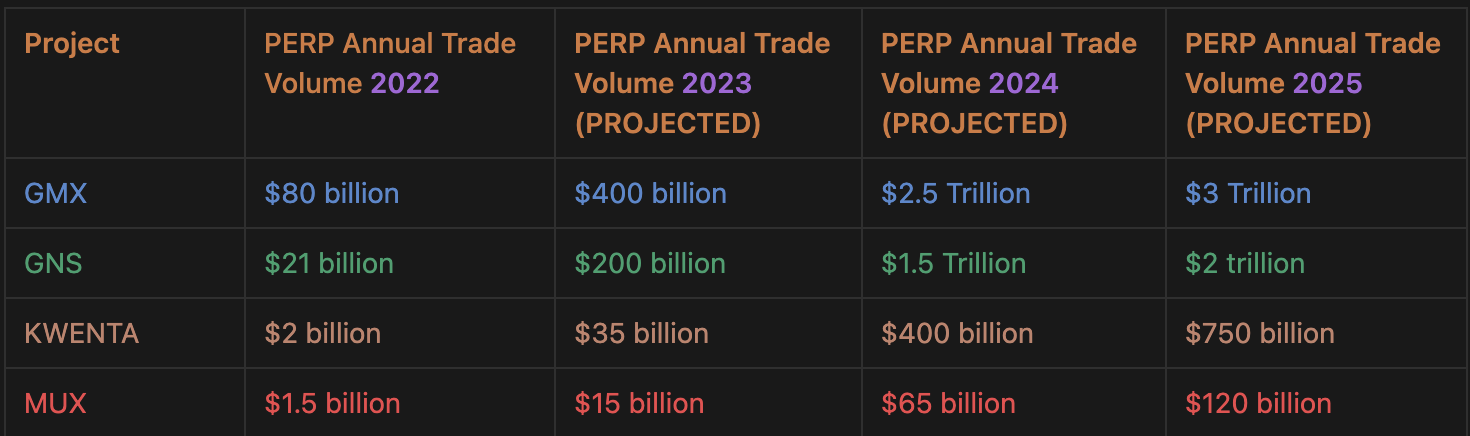

Growth Potential of PERP DEXs

Breaking the "Useless governance token" mold

DeFi tokens at this point in time get a bad rap, because most of them offer no utility, aside from being the voting power behind the protocols.

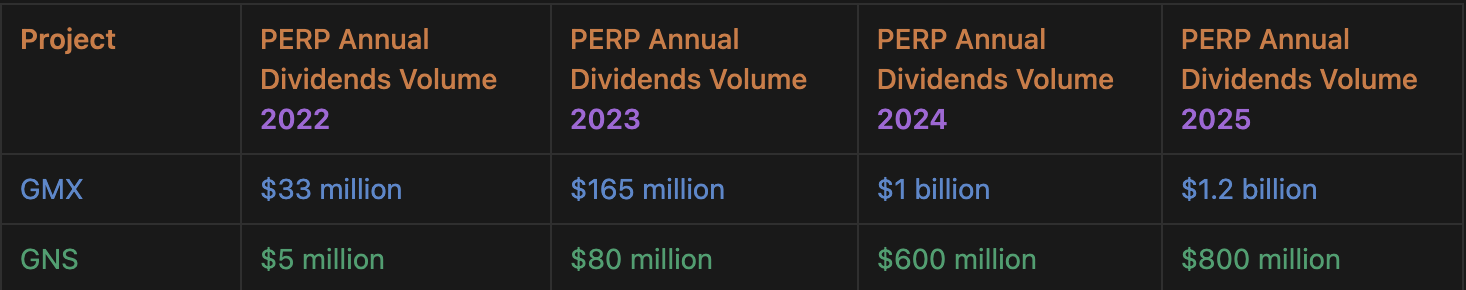

Luckily, the trend in PERP exchange tokens, has been revenue share from the jump!

This means these tokens we will mention basically receive direct dividends in real time, from the actual PERP exchange platform.

And when cash flow is involved, the appeal goes up, and the valuation model is no longer a grey area. Now lets see the growth potential.

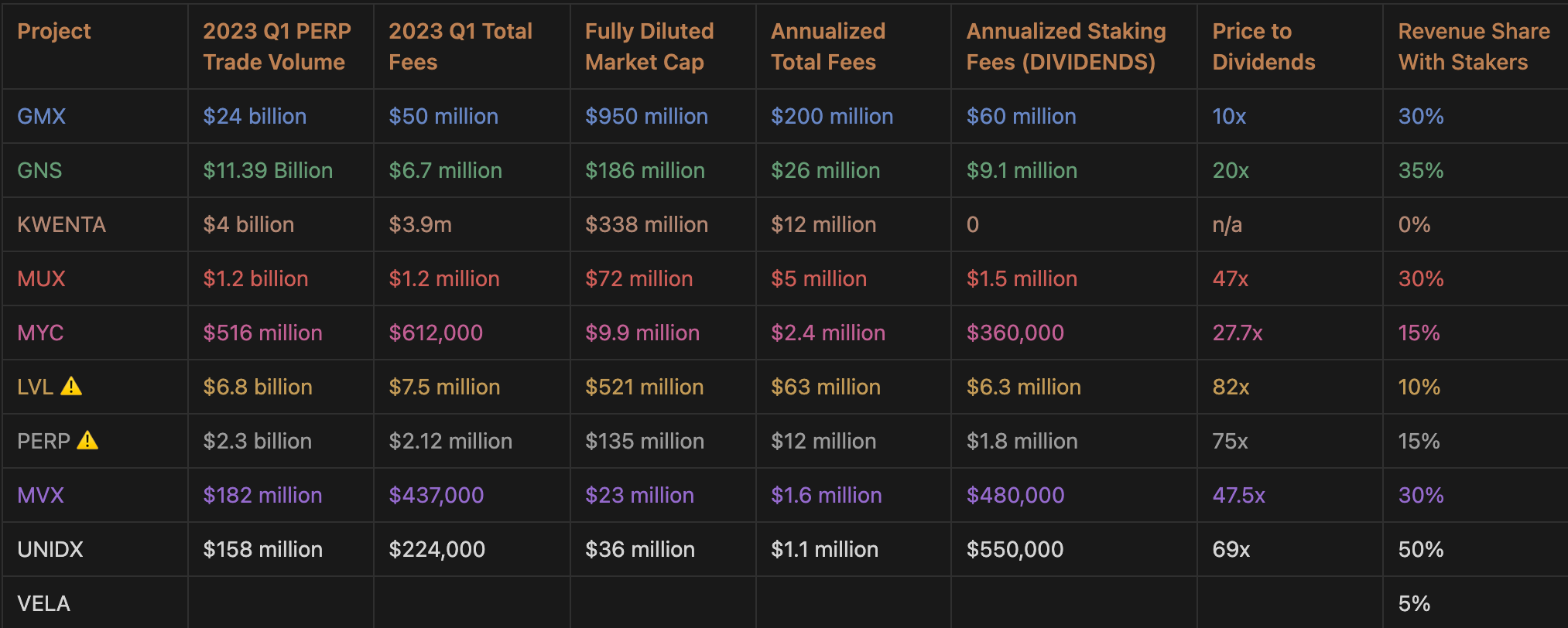

The DeFi PERP Token Watchlist:

- GMX - current leader (only offers 4 assets)

- GNS - the strong 2nd, (offers many crypto, stocks & commodities)

- MUX - PERP aggreagator leader (aggregates liquidity from dexs)

- SNX + KWENTA - (OG community w/ good product)

- VELA - waiting for mainnet launch, good branding

- OPX - brand new, super small micro cap

- UNIDX - aggregator

- PERP - Main site closed off to USA ⚠️

- LVL - Binance Chain PERPs ⚠️ wash trading volume, not organic

Do I own every single coin on this list? --> no (almost), I hold only trace amounts for most, but heavy on $GNS.

- My heaviest bet is on $GNS.

- Biggest conviction is in $GNS and $GMX

- Kwenta's PERP platform is tied to SNX stakers, although I believe KWENTA token holders will eventually receive dividends too, so still trying to find a balance.

- I am playing 'narrative roulette', betting VERY SMALL amounts across a lot of PERP coins, and a big amount on the 1 or 2 I have most conviction in (i.e GNS)

- Spray & Pray, willing to hold these for 12-18 months for max gains.

- I am also willing to be wrong, and lose some $$.

- Time frame for thesis is a little over 1 year (mid 2024), and I believe by then, PERP DEX volume should be very hot.

- Most of these have pumpamentals that will benefit if the PERP narrative plays out, and not great fundamentals, but crypto market follows trends and a raising tide lifts all ships (hence 'Narrative Roulette')

- Don't blindly follow any suggested coins here, DYOR.

Price to Dividend Formulation

Cashflow is king - crypto investors have a big appetite for revenue share, and PERP exchanges are all about it.

DeFi 1.0 tokens were / are criticized because the lack of revenue share, but as you can see above, HEFTY splits are already baked into these fresh PERP dapps.

These are 2 factors we look for when evaluating tokenomics:

- Fully Diluted Market Cap: tokens NOT in circulation today are just as important as the ones that are! If NIKE released a 1 of 1 shoe and sold 100 pairs, but 1,000 more pairs would be launched in 1 year of the same shoe, we should value the shoe as if there were already 1,000 pairs out.

- Revenue Share %: How much of the platform's revenue is being shared with token holders? 10%? 30%? This directly impacts the token's value!

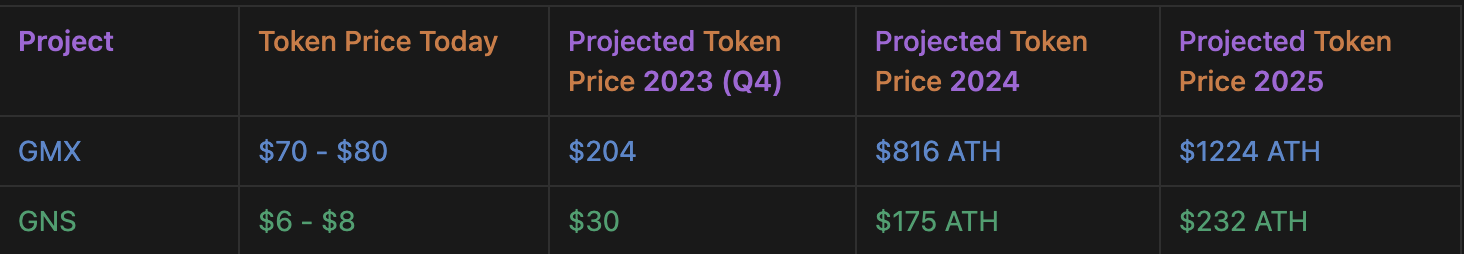

Future Dividend Growth = Future Price Growth

Traditional, publicly traded companies harp on the "earnings per share" metric because that gives each individual share some inherent value that can easily be measured. This just means you take the total profit, and divide it by the number of outstanding shares. With most PERP tokens giving revenue share to holders, this means the inherent value of them will grow along with the adoption of DeFi PERPs.

The 2 DeFi PERP Leaders of 2022

When Dividends (Profit) Increases, Price Follows:

- Market Cap Projected Growth

2. Price Projected growth

GMX 🫐 - Bull Case:

- GMX remains the leader in the DeFi PERP market

- GMX is able to release 'synths' update asap, adding more than just 4 pairs to speculate on.

- GMX is able to scale its open interest liquidity and make room for 100k+ users

- GMX platform eventually generates 2-4x the volume of Uniswap via PERP swaps.

- Arbitrum network keeps its impressive chokehold on the Layer 2 networks and attracts millions of new users next cycle (GMX is one of top apps on Arbitrum)

- 2024 bull market near the Bitcoin halving injects tons of new liquidity into crypto markets

GNS 🍏 Bull Case:

- GNS continues to win over users due to its wide variety of available PERP assets, even outside of crypto (it has stocks, gold, silver, forex)

- GNS is the sole leader in FOREX PERPs, a niche that is untapped elsewhere, and adds a big chunk to its total volume (and future growth of it)

- GNS remains the speculative "runner up" underdog to GMX, where people speculate on it potentially overtaking the leader, and constantly seeing it as an opportunity for higher ROI / gains.

- GNS able to scale its open interest liquidity and make room for 100k+ users.

- GNS enjoys the luxury of being on 2 of the most popular Layer 2 networks: Arbitrum AND Polygon, attracting even more users on each chain.

- 2024 bull market near the Bitcoin halving injects tons of new liquidity into crypto markets.

PERP Category Bull Case (In General):

- DEXs became a pillar of DeFi due to their un-avoidable presence.

- PERP DEXs will follow suit and become a pillar of DeFi derivatives

- Everyone will always look for "the next GMX & GNS"

- Hopium trickles down into any and all PERP DEX in the next 24 months

Invalidation (The Bear Case)

In investing, you must always have an invalidation case for your bull thesis, meaning: scenario of possible hurdles or bottlenecks that can make your predictions not come true.

While the centralized PERP market is a huge, growing, cash cow, it is not 100% certain that the decentralized PERP market can catch up and or win-over a meaningful amount of the market share.

Here are a few possible reasons:

- Liquidity - most DeFi PERP platforms are made possible through user-volunteered liquidity (Liquidity providers), and given the technical knowledge hurdle of using wallets, bridges, etc.. means its not easy for an everyday person to add to this liquidity, making available open interest limited.

- Scaling - scaling liquidity is one bottleneck, but can these decentralized platforms also handle millions of users? DAOs have to rely on contributors, customer support etc.. and it is much difficult for small teams to bootstrap scalable, organized teams that can handle millions of users.

- Regulation - the Perpetual swap market is a new crypto innovation and is not regulated. Binance recently got served with a court filing by the Commodities Futures Trading Commission (CFTC), for offering unregistered derivatives to US customers. This can get ugly if it has merit. This may add fear to DeFi teams building and hosting user interfaces (see dYdX and PERP protocol):

> had multiple perp accounts on @dYdX

— Salvino D'Armati (@SalvinoArmati) April 16, 2023

> was long af

> they ban canada

> forced to close and withdraw

> “slow” withdrawals only

> funds stuck in USDC while eth rips pic.twitter.com/PIy6Cl1SZ6

The timeline I have in mind here is also around 12-16 months out, around Q2 2024. If these platforms fail to grow substantially in volume and adoption by then, and it wasn't influenced by unforeseen macro events, then my thesis is wrong, and PERP speculators may just prefer using centralized entities such as Binance.

Summary

Many DeFi use cases are uncertain for growing adoption, but one use case is here to stay for certain: SPECULATION.

Even if DeFi lending, Prize Savings, NFT loans, or any other use case fails to see mass adoption, you can bet that people will always want to speculate on crypto tokens, its in our nature.

The market has also proven that leverage trading, whether for hedging investments or pure speculation, is the preferred method.

PERP volumes dominate spot trading volumes in the centralized world, and this thesis is a bet on the DeFi side catching up to the centralized side of the market.

DeFi is harder to execute, but much more rewarding for everyone involved.

Early DeFi tokens still get a bad rap for being 'useless' governance tokens, but PERP platforms have started a trend of direct revenue-share to holders and everyone is seeming to follow this trend. This gives merit and measurable metrics for growth and valuation for these PERP platform tokens, and up-trending usage of these protocols is literally making the tokens more valuable with the usage.

Enjoyed the report? Give it a share on Twitter! The 'copy link' and share buttons are at the top!

DISCLAIMER: NONE OF THIS IS FINANCIAL ADVICE, AUTHOR OWNS SEVERAL OF THE TOKENS MENTIONED, THIS IS A SPECULATIVE ARTICLE FOR RESEARCH AND ANALYSIS PURPOSES. DYOR - NFA - REPORT IS WRITTEN ON THE ASSUMPTION THAT THE DATA FROM 3RD PARTIES IS ACCURATE.