Inflation: The Invisible Tax:

It is hard for people to understand how inflation impacts them, simply because a $1 bill will still be a $1 bill in 100 years.

However, it's not the dollar bill that changes, its value is what changes.

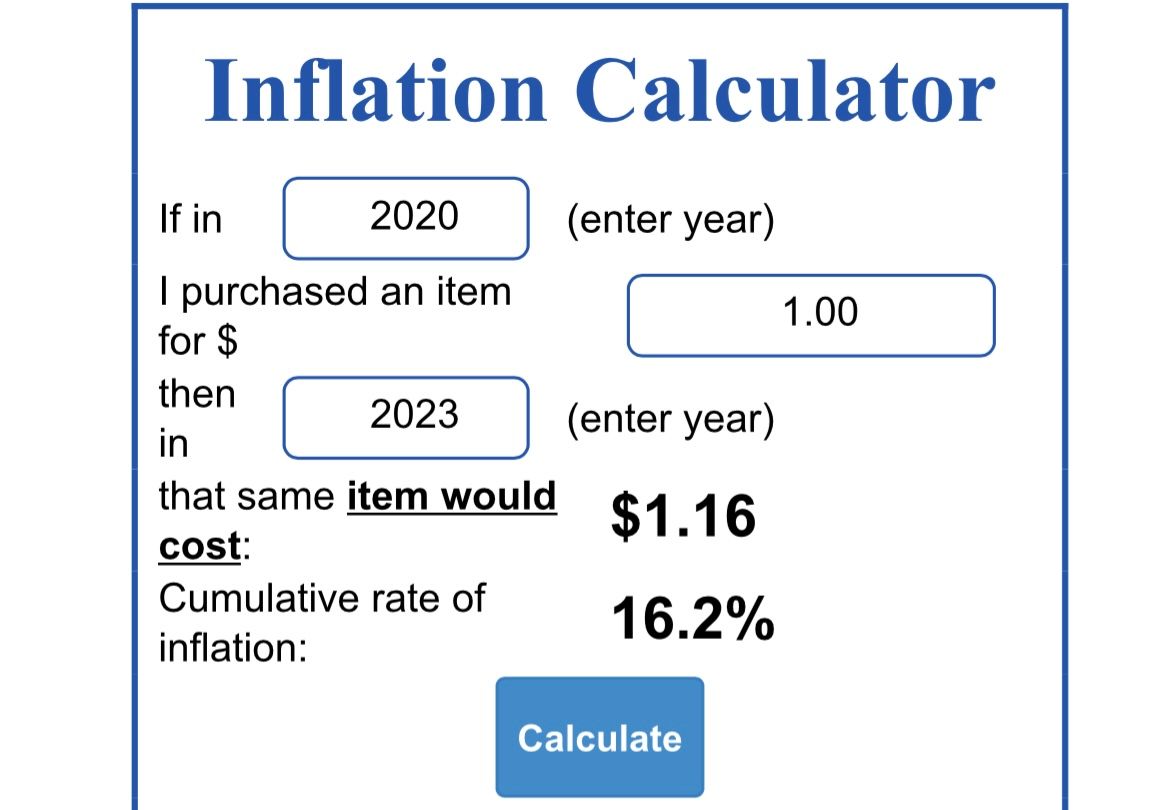

The calculator above shows that the same $1 bill from 2020, can now only purchase $0.84 worth of goods in 2023.

Buying Power

Its not so much that "things are getting more expensive", its your actual currency supply that is increasing, making each dollar bill less valuable.

Prices adjust according to the supply of a currency.

our precious dollars have lost 16% in buying power over the last 3 years.

— Kris Kay | 🦇🔊🍩 DeFi Donut (@thekriskay) March 28, 2023

BTC & ETH have gained 3x-6x in USD terms in the same time period.

inflation hedge after all? 🤷♂️

but pls tell me how you bought the 2021 top and are convinced otherwise. pic.twitter.com/SCkDwuCAyZ

Bitcoin and ETH Inflation Hedges?

When the crypto markets correct, people love to come out of the woodwork and ridicule people that call Bitcoin an inflation hedge.

But if we compare USD buying power change vs Bitcoin & Ethereum since the COVID money printer began, the results are damning.

Bitcoin & ETH vs USD

- ETH USD price change, May 2020 - March 2023: +731%

2. Bitcoin USD price change, May 2020 - March 2023: +204%

The Verdict?

Opposite to popular consensus, both Bitcoin and Ethereum have shown that they've actually outperformed every country's fiat currency, by a lot, since the pandemic driven money printer movement.

Numbers don't lie!

Is Bitcoin volatilie? Yes.

Is Ethereum volatile? Yes.

Have they both been great inflation hedges, even if unintentionally.

But there are few global assets that have performed as well in the past 3 years.

"There is no long term stability, without short term volatility"

Cryptocurrencies are still in their beginning stages, and volatility is always present in the early stages of any publicly traded asset.

Especially ones that are open 24/7.

Investing is risky, crypto is risky, stocks are risky, but we are very much interested in risk when it comes to bleeding edge tech.

Happy HODL'ing!

Disclaimer: Author owns Ethereum, and USD :D