Hyperinflation Is Scary

The whole world is battling inflation since COVID hit, due to irregular money printing / stimulus packages, but some countries have been fighting it long before.

Inflation is one thing, hyperinflation, is the final boss.

Twitter user, Steve Hanke, calculates the annual inflation of Venezuela to be around the 400% mark, as of March 2023!

Venezuela takes 2nd place in this week's inflation roundup. On Mar 9, I measured VNZ's inflation at 481%/yr. Chavismo has turned Venezuela into an economic nightmare. pic.twitter.com/49BIAC4TTz

— Steve Hanke (@steve_hanke) March 15, 2023

There are many estimates out, ranging from 150% to 450%, but we can certainly conclude that Venezuela's annual inflation rate is in the triple digits right now!

One Buger King Meal = 1 Month of Wages

- A Redditor "WorkingLime" is a Venezuelan Bitcoiner (living there)

- This person has been documenting the hyperinflation in Venezuela in real-time, over the last few years via an online forum called Reddit.

Flee To Safety

Hyperinflation is no joke.

We are born to attach value to paper bills (money is money right?)

We don't ask why its valuable, we just trust everyone else saying paper bills are valuable.

But it is only valuable if its supply is strictly controlled. Obviously, paper bills are printed, and if too many are printed in too short of a time-span, then the "value" they hold decreases.

In the above picture, you may think these are rich shoppers flaunting cash, but they are actually weighing it! So many bills have been printed, that counting enough money to buy regular items is too time-intensive!

So instead, they weigh the cash, and in that manner, know how much is on the table. Imagine that.

This begs the question,

if their savings are literally withering away in the wind at increasing rates every day, where will they flee to, for some stability and safety?

The Solution is Decentralized

The biggest criticism of Bitcoin and Ethereum are "it's too volatile!"

But imagine a scenario, using the past year's data:

- Bob held $5,000 of Bitcoin starting March 2022.

- Emily held $5,000 worth of Venezuelan Bolivars starting March 2022.

- One carton of milk cost $3 USD on March 2022.

- ..Fast forward to a year later (present day):

- Bob's Bitcoin fell 40%.

- Emily's Bolivars inflated 400% via excessive money printing.

- Bob can purchase 667 cartons of milk now.

- Emily can purchase 416 cartons of milk now.

Bob and Emily both lost purchasing power in the past year

Even though Bob's Bitcoin fell 40% in value, he still retained much more purchasing power than Emily, and Emily was simply holding her own country's native currency!

Bitcoin doesn't sound too volatile to Emily right about now.

Well this is not a made up scenario, this is how things really unfolded over the past 12 months.

Bitcoin in Venezuela

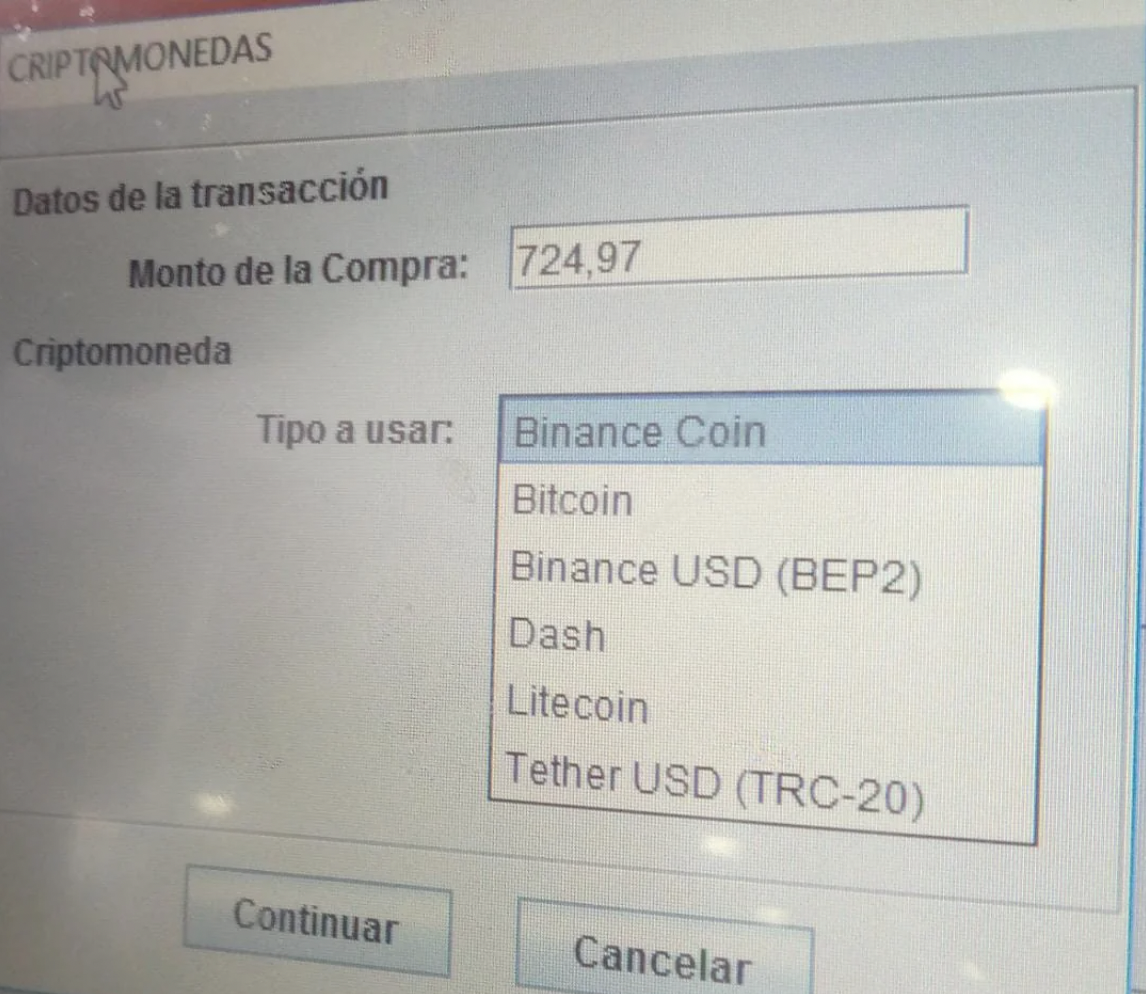

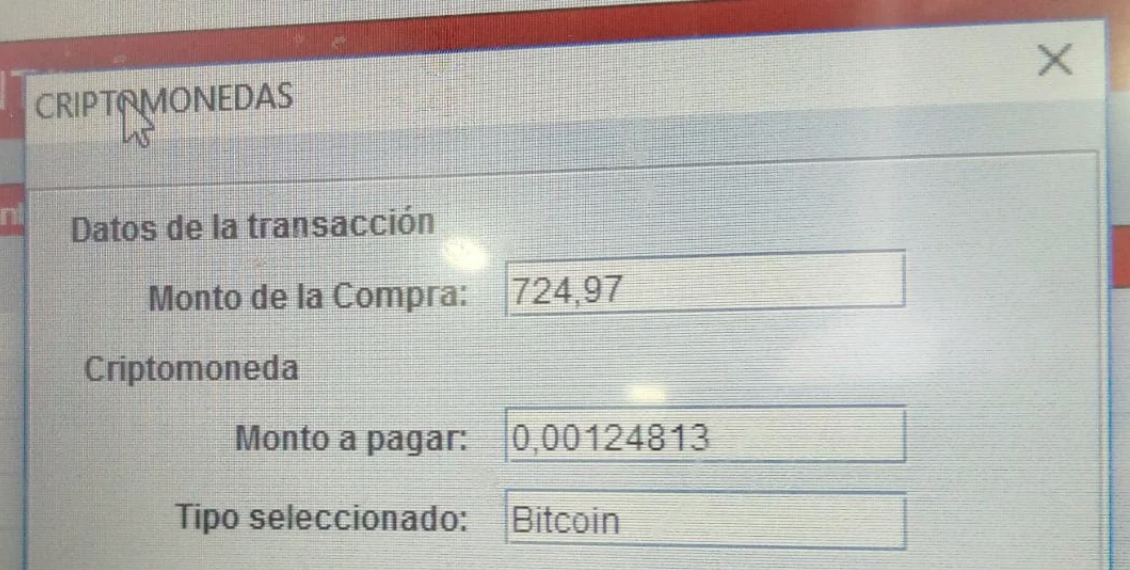

Our Venezuelan friend from Reddit is using Bitcoin to purchase groceries for this exact reason! They are choosing Bitcoin as a flee-to-safety, in order to protect their buying power, as opposed to holding their country's hyperinflating currency.

"You say to the cashier you want to pay in cryptocurrency and their system shows them a selection:"

"After selecting bitcoin and continue (Continuar) it shows the amount in bitcoin"

"I used Trust Wallet and the fee was 1.36 USD."

"Experience was good overall, but in this case I paid a little more, something to improve."

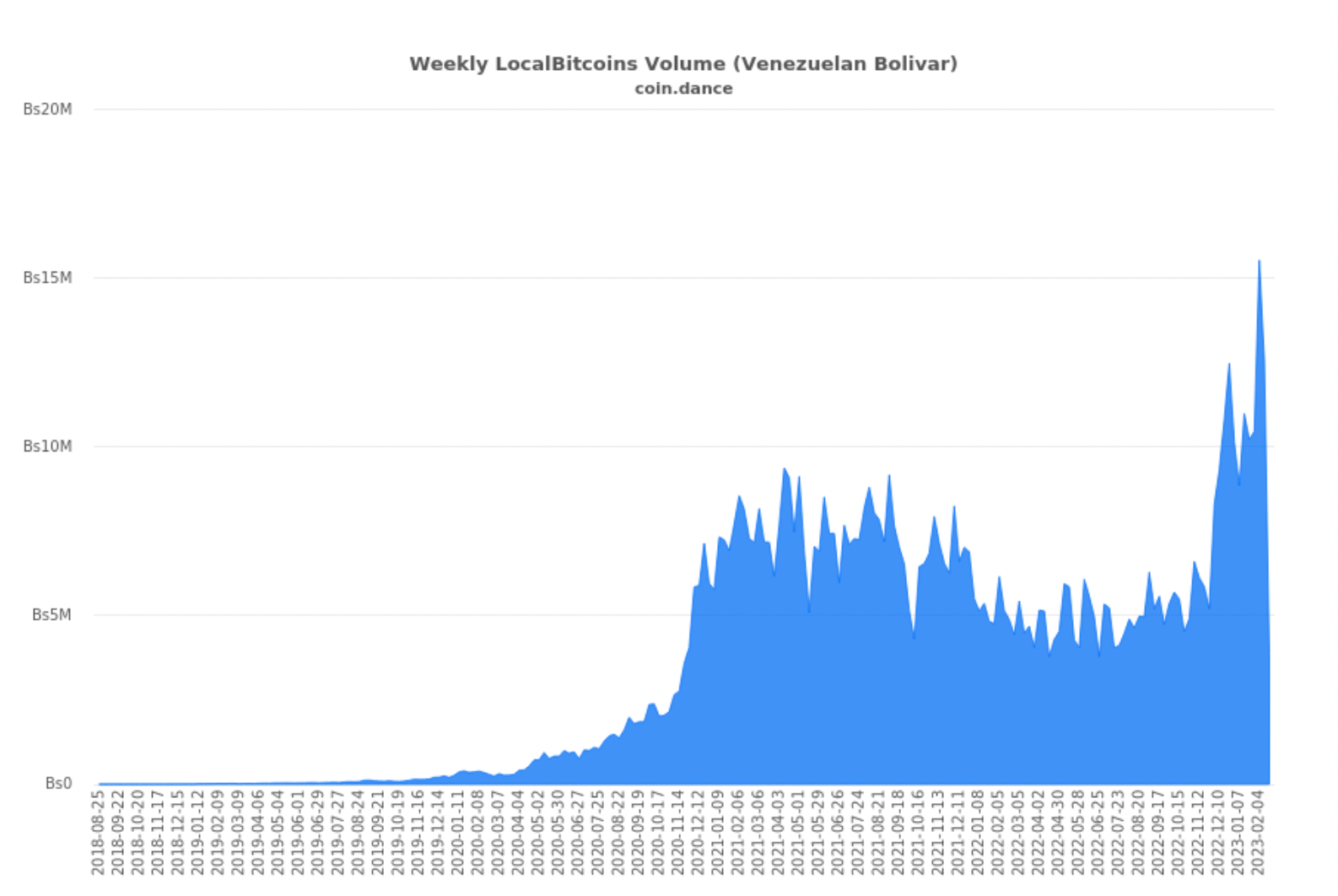

Is Venezuela Using Bitcoin?

While its not much in USD terms, the weekly volume data of Venezuelans using peer to peer Bitcoin exchange services are definitely trending up, even in a bear market, where everyone else seems to be shaken from the volatility.

The data proves one of the values of Bitcoin and cryptocurrency in general, having a borderless, global payment system, that is not dictated by any government.

A subset of Venezuelan citizens have who have opted out of their economy and into Bitcoin, have been to exchange value with each other, and even send or receive value from across borders.

Here To Stay

Bitcoin being over a decade old, and Ethereum closing in on a decade, we believe that if they were both a fad, they would have not only gone away by now, but no accumulated a near $1 trillion market cap between the two so far!

Some times we have to remember these are global blockchains with borderless currencies, and some economies may be displaying the value of these cryptocurrencies, before we realize what it is, ourselves.

If you enjoyed this article, feel free to share it with a friend!

Happy HODL'ing!